Description

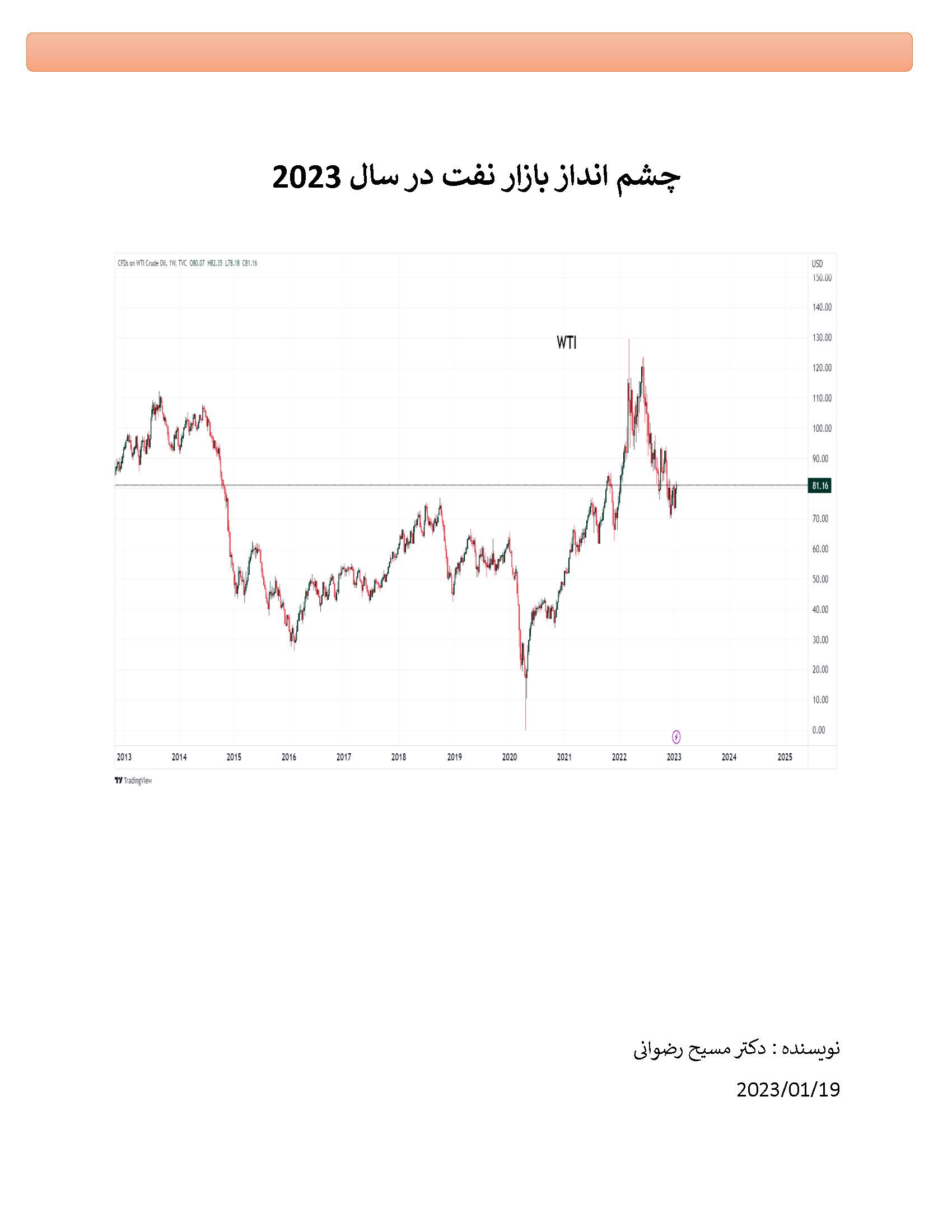

Oil markets are exposed to a series of shocks (such as Russia’s attack on Ukraine in late February and the sanctions and the cap on Russian oil imports, the coordinated response of oil-consuming countries (led by the United States) to control prices through The spread of strategic reserves, recessionary and inflationary pressures that affected the world economy, the increase in demand due to its strict policy against Covid-19 (and considerable changes in the trade flow of crude oil and petroleum products) was placed.

Of course, oil markets do not benefit from these shocks. Over the years, oil and petroleum products have been exposed to supply and demand shocks, but 2022 will see increased government intervention in world markets.

Energy, including oil markets, because the concerns related to energy security and affordable prices have become the key drivers of energy supply and demand regulation policy; in this, the increase in government interventions has increased the key uncertainties that are not affected not only the financial markets but also the oil and gas markets,

so that in 2022, with the increase in the interest rate and the insurance required by the major exchanges, the liquidity of interest will decrease. We have been both Brent and WTI, and the risk costs and low profit of trading in this market increased due to risk management and risk hedging and reducing the participation rate.

Reviews

There are no reviews yet.